-

Recent Posts

Recent Comments

- Hugh Pitts on Can I Get Vaccinated For That?

- Boris Seymour on Homerun!

- George Boardman on TRUMP OR…?

- RL CRABB on TRUMP OR…?

- Michael R. Kesti on TRUMP OR…?

Categories

Archives

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

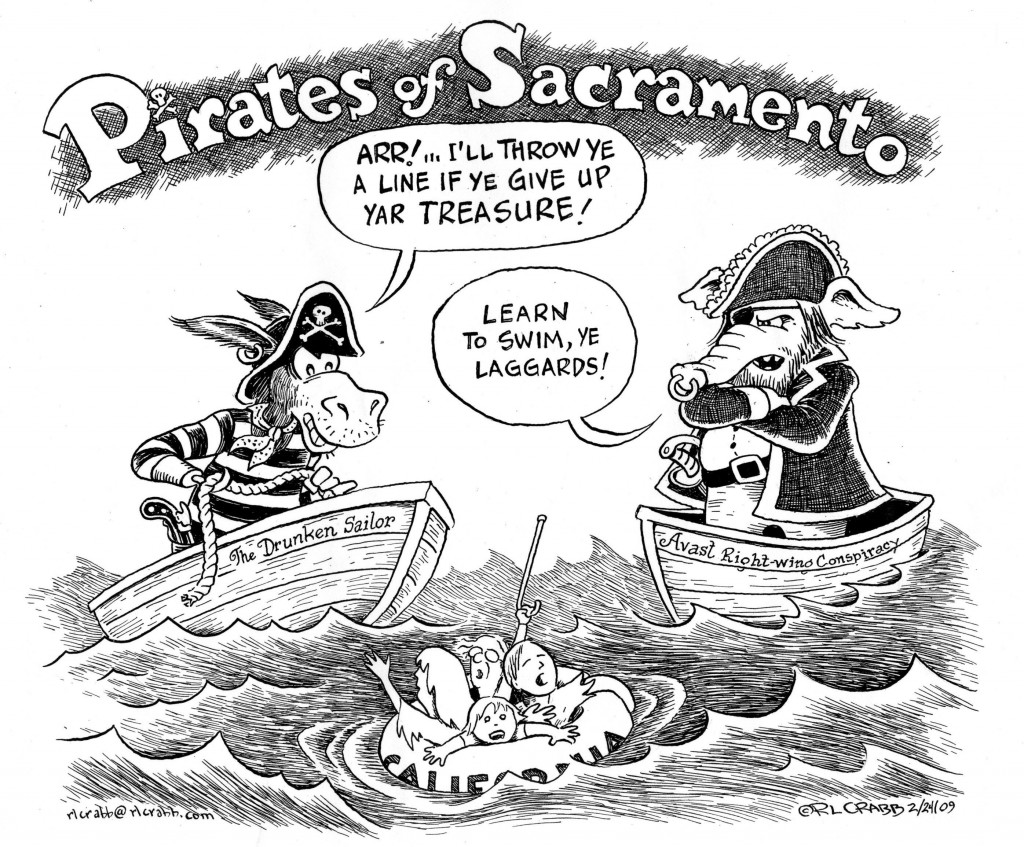

Aren’t the drunken sailors (as per your depiction) fully in charge in California and the Right Wing Conspiracy is merely being towed behind the citizen’s cruise ship in a small rubber dingy?

Actually, the Dems be a few votes shy of a six pack of grog, otherwise we’d be walking the tax plank without a referendum come November. Arrr!!!

Ryan,

With prop 13 standing the way it is we are a state that is controlled in many ways by the minority party. Yes, I am speaking of the 2/3 majority portion of prop 13. I haven’t read this website thoroughly but at quick glance seemed to cover my point.

http://californiansfordemocracy.com/p/salsa/web/common/public/content?content_item_KEY=3417

Oh Jeeze Ben. Now you’re gonna make me research stuff. BRB.

Ok. Back.

I feel compelled to respond to that link you provided, but I’ll do that in a second. Meanwhile…

I don’t know what to tell you. But it’s pretty darn close right now at 62.5% vs. 37.5% (and apparently rising in the Democrat’s favor). That’s pretty close to 33.3%.

Now I have lots of questions for you.

1) What specifically don’t you like about Proposition 13? I have my complaints for sure being a GenXer. My parents loved it however.

2) And what would you propose in place of it?

3) Do you have an issue with the more conservative supermajority rules/laws. Are you arguing for a simple majority? (yes or no and why?)

4) If you are in favor of a simple majority, aren’t you aware of the deliberate history of such things? Like in our US Constitution when we amend the it? Why not have that for our tax policies? Cue: Our old friend James Madison.

Now regarding your link (sorry for the delay. I do have a day job.):

FACT #1: California started out with a constitution that had majority rule!

So what? California started off with lots of things that we changed. This is not a reasonable argument. The majority of Californians appear to like this.

FACT #2: You can change the Constitution of California with an initiative that passes with a majority vote.

Yes, I believe the initiative process to be unConstitutional in our Representational Republic of California. It allows us the very tricky situation of allowing the electorate to vote on Rights, like same sex marriage. The thing is about Rights is you don’t vote on them. They’re innate.

FACT #3: The requirement of a majority to increase revenues stayed in place in 1933.

Again with the simple majority complaint. Why mention it twice? Probably because people aren’t paying attention. Anyhow, apparently Californians like this more conservative approach to raising taxes and revenue. Didn’t we try and fail to change this in 2004? Remember Proposition 56, which was defeated by 65.7% of voters said “no thank you”. Just saying…Bueller? Anyone? Bueller?

So much for Democracy, eh? Note for the math-challenged:that 65.5% vote was a supermajority! The irony.

FACT #4: Prop 13 was advertised as keeping property taxes low for elderly people who had bought their homes [snip. I turned the mic off this loud mouth. It’s getting on my nerves.]

Yessssss. I get it. Actually, we all get it. Proposition 13 was created to keep the elderly in their homes. Got it. However after speaking with my parents, who where decidedly middle class and in their 30s in 1978, they told me in no uncertain terms that their property taxes where driving them into renting. And, if it wasn’t for Proposition 13, they would have lost our home during the wage stagnation of the 1970s and 1980s.

Is there room for reform? From my perspective, yes. Is it going to happen? Probably not. People have come to see Proposition 13 as an entitlement. And we all know how that goes.

As for the supermajority, vs. simple majority? I think the voters have been clear on this point. (see my snarky comments above).

Ryan,

When the minority holds the purse strings and an anti-democracy agenda we will experience the atrophy of neglect to our grand democratic republic. That is exactly what we have been experiencing throughout the country for the last 30 plus years, especially in California.

Direct democracy just like most things doesn’t work very well on a mass scale and our proposition/ initiative process has become a misleading backdoor assault by misinforming the electorate through word games and emotions.

As for the simple majority question, we traditionally passed laws (tax law included) with a simple majority in California. If prop 13 would have passed with the same % it now forces the legislature the proposition would have failed.

The masterminds behind prop 13 were anti-tax republicans Paul Gann and Howard Jarvis. So it makes sense that this proposition misled the people and now has put CA between a rock and a hard place. My great great grandparents and my great grandmother came from Long Beach area to Carmel in the 1880’s by covered wagon. I have roots in California going back to pre US territory era. My parents and aunt/ uncles are in their late 70’s and early 80’s and we have talked extensively on the history of CA throughout their lives. California was much better off pre-prop 13. Most of my opinions on this subject have come from those conversations and comparing how our state worked pre vs post prop 13. Many of my relatives are party line republicans.

I do not like direct democracy for the same reason Snooki is on the NY Times Best Seller list and people look to Dr. Oz for their purchasing advice. And for that reason, I think the initiative process is a very poor substitute for citizen activity. If I could, I would get rid of it with a snap of my finger.

I would gladly throw out Prop 13 and replace it with something more sensible. To be honest, I think it violates our Californian Constitution’s equal protection clauses. (not to mention the Federal one in the 14th Amendment, but I’d prefer the Feds stay out of our business. We don’t need them adding insult to our self-inflicted injury.)

Peace.

Ryan wrote: “I would gladly throw out Prop 13 and replace it with something more sensible. To be honest, I think it violates our Californian Constitution’s equal protection clauses. (not to mention the Federal one in the 14th Amendment, but I’d prefer the Feds stay out of our business. We don’t need them adding insult to our self-inflicted injury.)”

Now this is where we are getting some traction, a cogent description of the problem rather than another story about all regulations being the villain.

Thanks for a great comment Ryan, and I also agree with you that the feds should stay largely out of our business, except for some very important exceptions:

* National Defense — properly scaled and not based upon Empire

* National Police Standards — based upon the US Constitution, specifically the Bill of Rights

* Most of the things under the Commerce Clause (though of course this is where PPACA is being reviewed, which is why I say “most” since PPACA may be overturned very soon; also, the Commerce Clause is a work in progress, and rightly so)

* Federal court system — thought SCOTUS needs some reform, like term limits

* Energy & Resource oversight — but only in conjunction with local governments and communities, the unfortunate Sagebrush Rebellion came out of federal insensitivity to local concerns

* Transportation — this is a subset of the “Energy & Resource oversight” exception, but I think it deserves its own exceptional mention: this is a problem that can only be managed on a national scale, many aspects of which are already onerously covered by the Commerce Clause…most of the work here needs to be about reform.

Michael A.

Ryan and Michael,

The best thing that could happen would be the strongest government in our lives would be our local government, then state, and last federal. Representative government closest to the people is the best insurance policy. Unfortunately big money sticks its nose/ pocket book in every nook and cranny of our nation and our representative form of government has been distorted at every level.

I’m a big stickler for Equal Protection and Due Process, but but not an absolutest. I know there are many practical considerations and accommodations we must make that may seem like we’re violated, at least in spirit, the Equal Protection Clauses.

My general complaint is people tend to ignore the 14th Amendment when it doesn’t jibe with their agenda. The two issues that immediately come to mind is the Progressive Tax System, and Same Sex Marriage, not to mention Prop 13. Sorry, that’s three.

I am not for no government or no taxes, but for limited government. And frankly Michael, I would be content with a Federal Government you’ve out lined above, although I would enjoy combing through the details of your proposal.

e.g. Term limits for SCOTUS? We have that. They can be impeached at any time, which has happened a dozen times or so in our history. Or we can amend the Constitution with a supermajority of the States. I’m not against the idea, but we already have mechanisms in place. And I kinda get the idea the Founders considered this issue. Hamilton worried about the judicial supremacy of the justices or what we might call “activist judges” acting more like Congress than their proper role as interpreters of the Law.

http://en.wikipedia.org/wiki/Federalist_No._78

Ryan,

You and I have touched on these issues with our federal government before. I think we are on the same page except for the progressive taxation. I will try and find the letters from the founders outlining their biggest fear of accumulated wealth influencing our government. Once that accumulation of wealth/ political power takes place we no longer are a nation of citizens but return to a nation of subjects. I think many who oppose progressive taxation see it as punitive. There is very little truth in this idea. The fact is we are the United States of America and are in this together as a nation not a bunch of individuals. I think this is the biggest difference between worldviews. One believes that we live in a society and the other believes that there is no society but rather a group of individuals. The more money we make the more we use the commons (roads, schools, energy, water, courts, police/ fire, ect…). Thus the more we should be investing in these commons. Working hard and earning a good living is what we should strive for but there is a point where “earning” max’s out and exploiting takes its place. This was understood extremely well at the founding of this country and is why the revolution was fought. We were colonies of big business e.g. Briton’s interests. The tea party was about a corporate tax exemption that allowed East India Trading Company to undercut local tea merchants, which was the final straw. This same bs goes on today and I would argue the corporate tax breaks for big box stores is the very same idea. My wife and I owned/ operated an ice cream/ sandwich shop in Colorado and we understand fully the threat to small business’s of big box stores. I will stop here before I go on a really long rant.

Our national economy should be made up of local economies but for a couple decades we have had a national economy that affects our local economies. We have an economy, government, and taxation system that benefits the top down failed policies of Supply Side Economics and it is slowly killing our nations social mobility.

Hi Ben-

I am going to address your comments in two posts. First, my argument against the Progressive Tax system which admittedly has 259 supporters across the USA.

I do not see the Progressive Tax system as equitable in any fashion. Not one. Zip. Nor is it efficient, but I’m not expecting government to be efficient. I actually like it to be slow and deliberative.

Anyhow, ideally I suppose you are correct. And if it functioned as you are implying, then goodie.

However in practice…Warren Buffett? GE? That is to indict two whom are in the public consciousness as of late. Now there are many reasons for this, most of which can not be fully detailed in RL’s Blog. In the past I have specifically addressed this:

* Federal revenue collection has consistently been ~18% of GDP since WWII regardless of the tax policy. That is, of course, a fact.

* Warren Buffett, et al behave the way they do because we enable them. We only want him to pay 15%. I don’t know why he just doesn’t donate his money to the USA. You suppose he knows something we don’t? We’re such suckers.

* We will never (and I mean never, like as in “forever”) close the loopholes, and remove odd deductions and credits (free money). We will vote ourselves free ice cream at every opportunity. Sarcasm translated via example: imagine taking away the home mortgage deduction. Ponder that just for a minute, and bingo, there’s the problem in a nutshell. Alexis de Tocqueville warned us, and we ignored him.

My suggestion is and will continue to be a Federal Consumption Tax (States can do whatever they want) with provisions (rebates) for certain classes of underprivileged citizens. No deductions. No Credits for your Prius or solar panels. No Mortgage deduction(s). No write-offs for Las Vegas junkets. Nada.

And pulleeeze. It’s doesn’t have to be “regressive.” (see above) What an ugly word.

But heck, I’m flexible. Let’s start with am 18% Consumption Tax on Corporations, since they’re not paying anything anyway. Tax consumption, not production. And leave the Progressive Tax system in place for citizens, because we appear to like the abuse from this inequitable cat-and-mouse tax game.

Or screw it. Let’s just keep the the same old 1913 Monster in place and make it even bigger with more rules and laws and loopholes and deductions and credits until I can get a credit for taking more than one crap in the morning. (TMI?) How’s that working out for us? Let’s ask Mr. Buffett.

Ben-

Part Deux.

The fact is we are the United States of America and are in this together as a nation not a bunch of individuals.

That is an assumption and a proposition that concerns me. It seems to be the same reasoning that leads to conclude that if you weren’t supporting the Iraq wars, then ostensibly you weren’t supporting the collective America. (whether that was true or not, is not really the point. The question is a direct one: do individual rights trump collective ones. I think the answer is a gray “sometimes.” The good news is I wasn’t thrown in jail for opposing the King and his overseas wars.)

One believes that we live in a society and the other believes that there is no society but rather a group of individuals.

Can’t it be both? Isn’t it a dance between the two?

The more money we make the more we use the commons (roads, schools, energy, water, courts, police/ fire, ect…). Thus the more we should be investing in these commons.

I agree with that. Actually, I’m gonna go out on a limb and say that the vast majority of Americans agree with this.

Working hard and earning a good living is what we should strive for but there is a point where “earning” max’s out and exploiting takes its place.

A couple of things. First off, I think your word choice of the conjunction “but” is significant here. Perhaps you meant “and?” Because if you meant “but” then we’re marginalizing successful people. I dunno, maybe that’s your intention.

Secondly, it’s one thing to proclaim what’s “max’s[sic] out”, it another to define and develop policy around it. And the wealthy don’t much care for our Progressive Tax system. At least the one I’m assuming whom you refer to as maxed. They don’t care so much that they have lots of people who work full time to bury their income. GE’s a good example. They spent lots of money lobbying the Ways and Means committee for “tax reform.” Looks like that reform paid off for them in spades. Of course there are many ways the wealthy can bury their money as well, trusts, overseas, etc.

This same bs goes on today and I would argue the corporate tax breaks for big box stores is the very same idea

Again…Equal Protection. You ain’t got none.

Our national economy should be made up of local economies[snip]

Well local isn’t going to provide the economy of scale us entitled Americans have grown used to and frankly demand. I mean we could return to the turn of the previous century when local markets stocked local things. And customers had a selection of a few items. Not to mention the cost of food has dropped dramatically since then from something like 40% of a family’s income to down below 10% now (I need to verify this, but I’m close). Bought local eggs recently at $6.00/dozen or more? I love ’em! But $6.00/dozen eggs ain’t all that attractive to a family on a limited income.

Our modern economy is marked by gigantic extensive distribution chains which have provided variety to the modern consumer. So although I support local efforts, I am priviledged enough to be able to afford them. Quick: there’s a tax metric. Tax me more!

Ryan,

I will just address the 18% number and then I am off to bed. I think we are somewhere in the range of 23- 25% GDP is government spending. When did it start to become more than 18%? What policies changed? It happened in the 1980’s and the policies that changed were the policies that reversed the reinvestment incentives. What built the biggest/ strongest middle class in world history were these policies. High Top Marginal Tax Rate, Import Tariff around 25%, 33-50% federal revenue from corporate taxes, and a 25% unionized work force. All of these policies made the incentive to reinvest the capital where it came from at the same time allowed the wealthy to live a very high standard of living. It was called 1940’s-1970’s. Then the Reagan revolution happened and the incentives became to keep the money and to invest in buying off government to increase profits. From 1976 to 1992 the cost of running a presidential campaign increased about 10%. From 1992 to 2008 it increased 400%. It took about a decade of changed policies for wealth and power to be accumulated to completely corrupt our federal government. We now have a duopoly for big business and the people have very little to no representation due to the fact that both parties cannot upset their big donors too much. Financial reform was a joke as is our policies on immigration because big business will not stand for it. Hold big business accountable and we will see an abrupt turnaround of the health of our nation.

I had a long day and need to try and get some sleep. To be continued.

Ben-

Revenues were highest (post WWII) under Clinton/Gingrich @ ~20% of GDP. And lowest under Obama/Bohner @~15%. If you average them together, you get 17.5%. Round it up, you get 18%.

Not sure why you’re moving the goal posts (you are) by shifting the talk revenue collection to spending. I suppose, and I’m being gracious here, that it’s an attempt to rationalize our spending needs/requirements. In other words, we’re currently spending on what we actually *need* (“actuals” in biz speak), and taxing far lower than that.

But just for the record, there are many people who are suspicious (some hostile) to this this approach of “spend now, pay later.” Me? Here’s my exact unequivocal position: If you want to spend, make sure you have the cash first. Yeah, it’s OK to borrow during emergencies (war, famine, Oprah book tours), but those are exceptions.

Even doves like Krugman have noted the 15 trillion (and growing) Federal public debt.

My position is we’re under collecting and we’re over spending. Is there any real argument about that? They are not mutually exclusive propositions.

However raising the marginal rates in our voted-on Progressive Tax system is going to be a useless exercise on the people you wish to target. You’re just going to end up banging on the middle to upper middle class how do not have the resources to pull a Mitt Romney.

See free ice cream comment above. They’ll just bury their monies elsewhere. They’re much smarter than the government.

Ryan,

I was assuming you were connecting the revenue to spending. I will keep it to revenue only.

100% of the federal budget was funded through corporate taxes through the Civil War. That number dropped to somewhere around 35% during the Eisenhower years. Today that number is around 8%. I have never researched % of tax revenue to GDP but you seem confident in that number. We have seen over the last 30 plus years the effective tax rates for both the extremely wealthy and big corporations dropped tremendously. In return we have seen the absolute corruption of our representative government. We have seen incentives for management/ administrators to direct money into their pockets instead of reinvesting back into where the wealth was created. At the same time workers wages have remained stagnant and even dropped when adjusted for inflation. Cost of living has exploded but wages haven’t followed suit. Why and how did this happen? As our government is bought off by this fraction of the top 1% loopholes, shelters, and amnesties for repatriating money come into play through legislation or turning a blind eye. My guess the same amount of wealth is being created but just a different set of policies/ incentives are now in place. I am a broken record stuck on a loop with this but virtually every major problem we have in our nation at the present time stems from huge sums of accumulated wealth corrupting the system. Taxation and rational trade policy (incentives) are the way to secure our nation from such destructive factions and it will stabilize our economy. It wasn’t an accident that the House of Representatives were given the powers of taxation and spending in the Constitution. HoR were the only federal publicly elected representative at our nations founding. A federal government by citizens closest to the people. I get the feeling we are talking/ typing passed each other and will stop.

Article I Section VII

“All bills for raising Revenue shall originate in the House of Representatives; but the Senate may propose or concur with Amendments as on other Bills.”

http://www.usconstitution.net/xconst_A1Sec7.html

OK.

BenE is too young to remember the old farts being booted from their homes because they could not pay the ever increasing property taxes. It seems the government was growing as it has ever since, to the point they were spending more than they were bringing in. Where have we heard that before? Anyway, we as a state just dropped the requirement to pass a budget to a simple majority. We also passed a proposition that said any tax or fee increases require a 2/3 vote. Well, what has happened BenE? The state democrats, in charge all of my life, still cannot make a budget work or balance the dollars (weren’t the Republicans the reason?). But, they thumbed their nose at the 2/3 vote requirement on fees and taxes and shove a “fire” fee down our throats. So, if you think it was unwise to have a Prop 25 you are sorely mistaken. The democrats will tax, fee and exact on everything they can and only the feeble attempts of a few people have been able to stop the tide. Well, actually we have not stopped the tide. And you blame the super minority of Republicans? Unbelievable!

Having just been booted off the prop 13 exemption, I am more than a little irked. My family has owned this house for more than sixty years, my name has been on the title for twenty-five years, I have been residing here for seven years, but because I worked and slaved to pay off the half interest to my brother, it is considered a change of ownership. My taxes more than doubled from an assessment that the county just arrived at by guessing how much the house and property is worth. Nobody even looked at the place.

I also understand that if I should sell, the govt. will take a chunk for medicare. Such a deal. I should have sold the place, bought a few pounds of gold seven years ago, and stayed a renter. That’s about all I am now, except I get all the responsibility of maintaining the home. Fiddlestix.

RL you should consult a real estate attorney. I think family members are treated differently under change of ownership than arms length transactions. Call Sue Horne at the Assessors office.

Regarding the tax on home sales to fund Obamacare. Wasn’t it democrat Pelosi who said we need to pass it so we can find what the hell is in it? Yep, and the tax is just one!

I’m reminded of a bumper sticker seen in SoCal about the time Prop 13 was being born. It was also about the time that a famous film director had fled the country to avoid prosecution over his fling with a minor: “Roman Polanski says yes on 13!”

Didn’t he get recalled recently?

RL,

That is the absurdity of prop 13, it is a group of issues lumped into one proposition almost assuring its survival. The residential property tax is what will make amending it almost impossible because special interests groups will mislead people into believing it will be there property tax that will increase instead of fixing the existing problems. If we want to look at revenue/ balanced budget this is one gigantic issue.

Todd,

Let this young whipper-snapper educate you on the destructive aspects of prop 13. First CA with high individual top marginal tax rates and corporate tax rates was the Golden State through the 1950’s through the 1970’s. We had the top university system in the world, in top 5 public schools in the nation, an infrastructure of roads and water-ways that were the envy of the rest of the nation, which is the reason for CA being consistently one of the top economies on the planet, and we had a $5 billion surplus. Then 1978 and prop 13 came in promising the people to keep more of their money in their pockets.

5 destructive aspects of prop 13

1) Over 60% of the total benefits of the property tax provision went/ goes to commercial/ corporate properties.

2) 2/3 super majority needed to raise taxes, basically minority rule

3) Other taxes such as sales tax, parking meters, ect… increase for a regressive affect hitting those with lowest incomes hardest

4) Schools see there revenue source from property tax stagnate despite increasing needs

5) Housing markets tighten up forcing communities to embrace strip malls for their sales tax revenues

Ben,

You forgot to mention that Todd’s parents paid a higher percentage of income to taxes (of whatever kind) than he does today. State tax revenues as a percentage of gross state product has actually gone down since the 1970s when Reagan was governor.

In my view, part of the problem is that we baby boomers are not willing to finance the state as generously for our kids, as our parents did for us. I still can’t figure out why our kids (people like Ryan) don’t turn around and soak us at the same rate as we did their grandparents!

Tony

Thanx for not channeling S.Clay Wilson on that toon…

An even worse aspect of pre-13 property taxation is that the assessment didn’t have to be based on how the property was being used, the assessment was based on the value if it had the most profitable use envisioned by the county Assessor. So, for example, strawberry farmland in Camarillo got taxed as if it were loaded with condos like the former strawberry field down the road. So lots of strawberry farms got shut down and paved over. This was perhaps the biggest abuse the drunken sailors of old let stand because they loved the windfall tax collections they got to spend as a result.

Dems have had a stranglehold on the California state checkbook for years, and we are already perhaps the highest tax state in the US. The insolvency of Sacramento is not because Republicans have stood in the way of even higher taxes.

Drunken sailors arrrr a perfect representation, thanks RL.